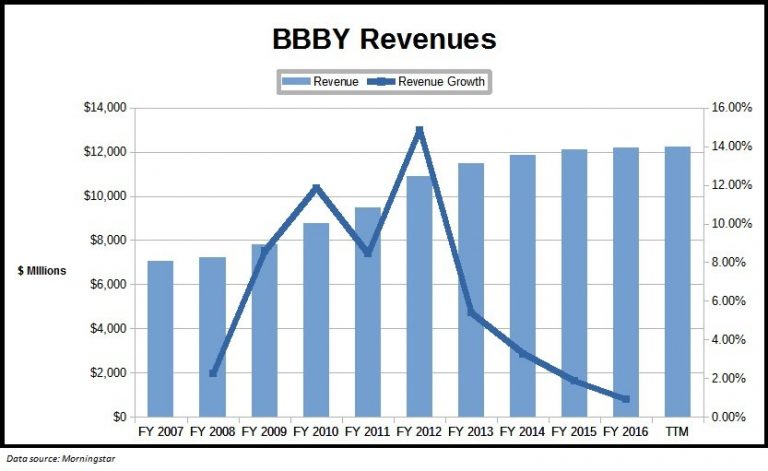

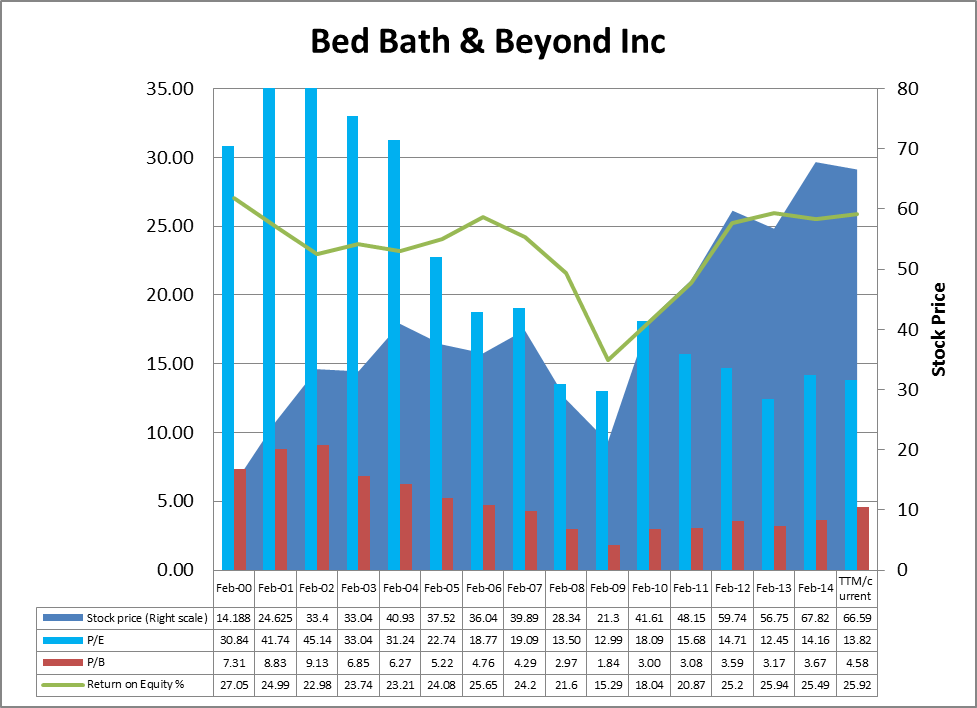

That said, the market might be overestimating the company’s turnaround potential of shedding its non-core assets and focusing on its digital future in the near term. This stock and revenue mismatch signal a potential slump in Bed Bath & Beyond going forward. The company was already struggling in this regard even before the coronavirus - with sales falling 7% in 2019. The home goods retailer’s revenues have declined 25% so far in fiscal 2020. (Photo by John Nacion/SOPA Images/LightRocket via Getty Images) SOPA Images/LightRocket via Getty ImagesĪfter almost a 20% increase in Bed Bath & Beyond’s stock (NASDAQ: BBBY) since the beginning of this year, at the current price of around $21 per share, we believe the retailer now has a significant downside. This announcement appears to be the first iteration of that plan, report says.

Bath & Beyond has announced plans to permanently close about 200 stores over the next two years. financial leverage ratio increased from 2020 to 2021 and from 2021 to 2022.NEW YORK, NY, UNITED STATES - 2: Bed Bath & Beyond logo seen at one of their branches. debt to assets ratio (including operating lease liability) improved from 2020 to 2021 but then deteriorated significantly from 2021 to 2022.Ī solvency ratio calculated as total assets divided by total shareholders’ equity.īed Bath & Beyond Inc. debt to assets ratio improved from 2020 to 2021 but then deteriorated significantly from 2021 to 2022.ĭebt to assets ratio (including operating lease liability)Ī solvency ratio calculated as total debt (including operating lease liability) divided by total assets.īed Bath & Beyond Inc. Bed Bath & Beyond Inc Follow Share 0.23 After Hours: 0.24 (1.63) +0.0038 Closed: Sep 8, 4:00:04 PM GMT-4 USD OTCMKTS Disclaimer search Compare to SVB Financial Group 0.070. debt to capital ratio (including operating lease liability) deteriorated from 2020 to 2021 and from 2021 to 2022.Ī solvency ratio calculated as total debt divided by total assets.īed Bath & Beyond Inc.

#BED BATH BEYOND STOCK LONG TERM OUTLOOK 2018 PLUS#

debt to capital ratio deteriorated from 2020 to 2021 and from 2021 to 2022.ĭebt to capital ratio (including operating lease liability)Ī solvency ratio calculated as total debt (including operating lease liability) divided by total debt (including operating lease liability) plus shareholders’ equity.īed Bath & Beyond Inc.

debt to equity ratio (including operating lease liability) deteriorated from 2020 to 2021 and from 2021 to 2022.Ī solvency ratio calculated as total debt divided by total debt plus shareholders’ equity.īed Bath & Beyond Inc. debt to equity ratio deteriorated from 2020 to 2021 and from 2021 to 2022.ĭebt to equity ratio (including operating lease liability)Ī solvency ratio calculated as total debt (including operating lease liability) divided by total shareholders’ equity.īed Bath & Beyond Inc. 09, 2020 3:26 AM ET Bed Bath & Beyond Inc. A solvency ratio calculated as total debt divided by total shareholders’ equity.īed Bath & Beyond Inc. Bed Bath & Beyond Inc.s fiscal 2021 fourth quarter conference call with analysts and investors will be held today at 8:15am EDT and may be accessed by dialing 1-40, or if international, 1-86, using conference ID number 64632327. Bed Bath & Beyond: Stock Price Tied To Order Fulfillment Process Oct.

0 kommentar(er)

0 kommentar(er)